What the One Big Beautiful Bill Means for You

Congress just passed a sweeping new tax law — the One Big Beautiful Bill Act — and it includes several major changes that could impact your finances over the next decade. Rather than boring you with the entire 800+ page bill — I’ve pulled out a few key updates that are relevant for mid-career women in tech:

📉 Tax Brackets Made Permanent

The current lower tax brackets (10% to 37%) are now permanent, avoiding the scheduled jump back to higher pre-2018 rates. This offers long-term tax savings for most households.

💸 Standard Deduction Increase

The higher standard deduction is now permanent and will adjust annually for inflation:

$15,750 for Single

$23,625 for Head of Household

$31,500 for Married Filing Jointly

🏡 SALT Deduction Cap Raised (Temporarily)

The cap on state and local tax (SALT) deductions rises to $40,000, phasing out between $500K–$600K in income. Especially helpful if you’re in a high-tax state and own a home. This provision sunsets in 2030.

👶 Childcare & Family Support

Dependent Care FSAs: Limit increases to $7,500 starting in 2026.

Child Tax Credit: Increases to $2,200 per child in 2026, with annual inflation adjustments.

New Trust Accounts for Children: Up to $5,000 per child, with limited uses. Eligible children may receive a $1,000 federal match.

❤️ Charitable Giving Gets a Boost

New above-the-line deduction: $1,000 (individual) / $2,000 (couples), even if you don’t itemize.

Itemizers now face a 0.5% income floor before donations count.

💼 For Self-Employed or Side Hustlers

The 20% Qualified Business Income (QBI) deduction is extended. The income phaseout for service businesses increases to $150K starting in 2026—great news for consultants and freelancers.

👵 Seniors Get a Temporary Deduction Boost

From 2025–2028, people age 65+ get an additional $6,000 exemption. Begins to phase out at $75K (single) / $150K (married).

🏛️ Estate & Gift Tax Exemption Increased

The estate tax exemption is now $15 million per person, indexed for inflation—important for those with substantial investment, business, or real estate holdings.

Note: These are just a few of the highlights, but hopefully this gives you an idea of some of the opportunities that may impact you. The information presented in this post is based on my best understanding of the provisions found in H.R. 1. These interpretations may change over time with additional information and further guidance from the IRS. More to come!

💡 Looking for more guidance?

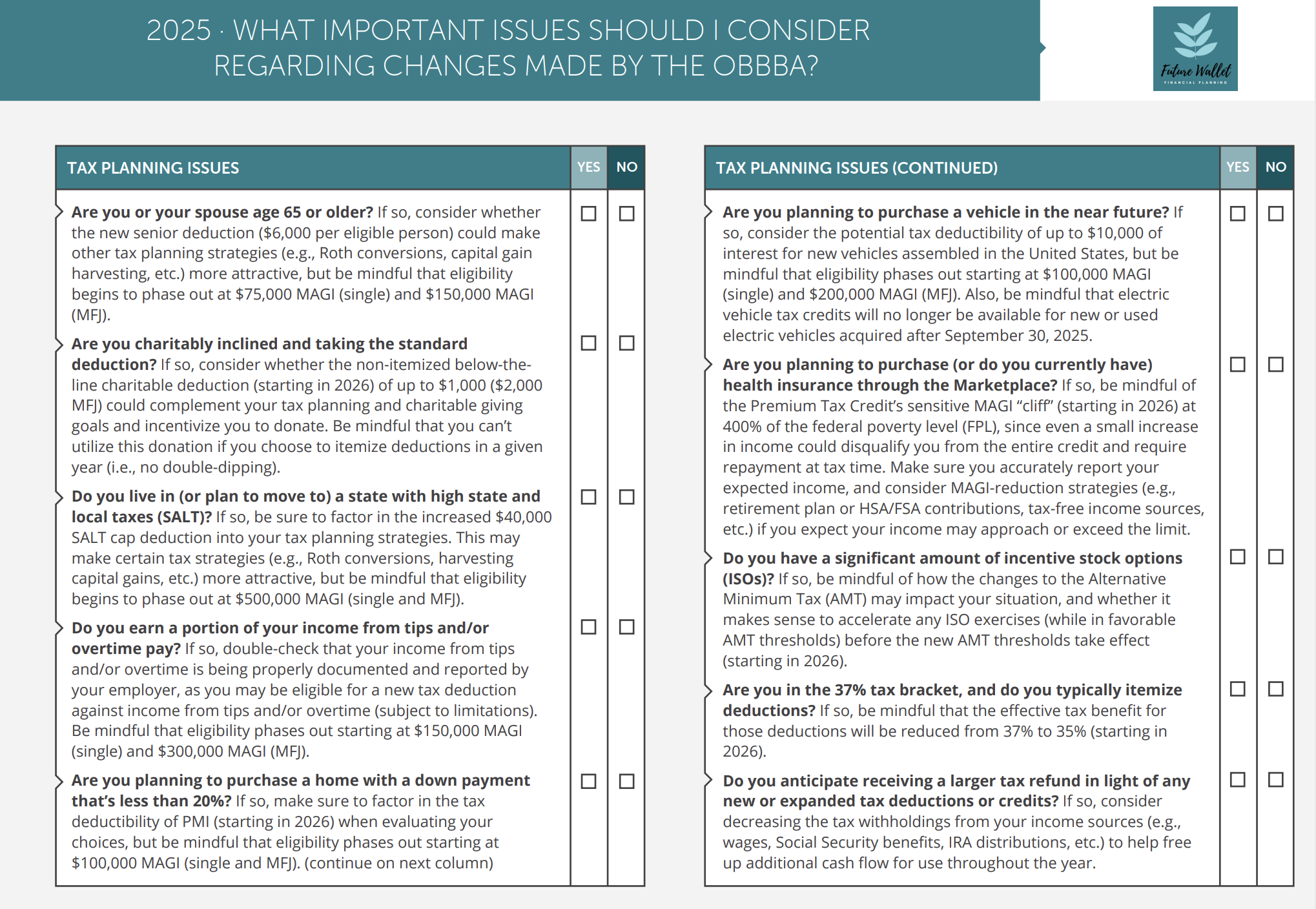

Click the image below to download a list of tax planning moves to consider related to the One Big Beautiful Bill:

Do you need help understanding how these changes might impact your financial plan? Schedule a call here if you’d like to learn about how we support clients with tax planning.